Table of Contents

ToggleHow to Calculate Company Valuation: A Complete Guide for Businesses

Understanding a company’s valuation is essential for business owners, investors, and stakeholders. Whether you’re planning to sell your business, attract investors, or simply assess your company’s financial health, knowing how to calculate company valuation is crucial.

What is Company Valuation?

Company valuation is the process of determining the economic value of a business. This valuation helps in investment decisions, mergers, acquisitions, and financial planning. Different methods exist to calculate company valuation, each suited for specific business models and industries.

Why is Company Valuation Important?

- Attracting Investors – Investors want to know the worth of a business before committing funds.

- Selling a Business – If you’re planning to sell your company, an accurate valuation ensures you get a fair price.

- Mergers & Acquisitions – Businesses looking to merge or acquire other companies need valuation for negotiations.

- Financial Planning – Knowing your business’s value helps in making informed financial decisions.

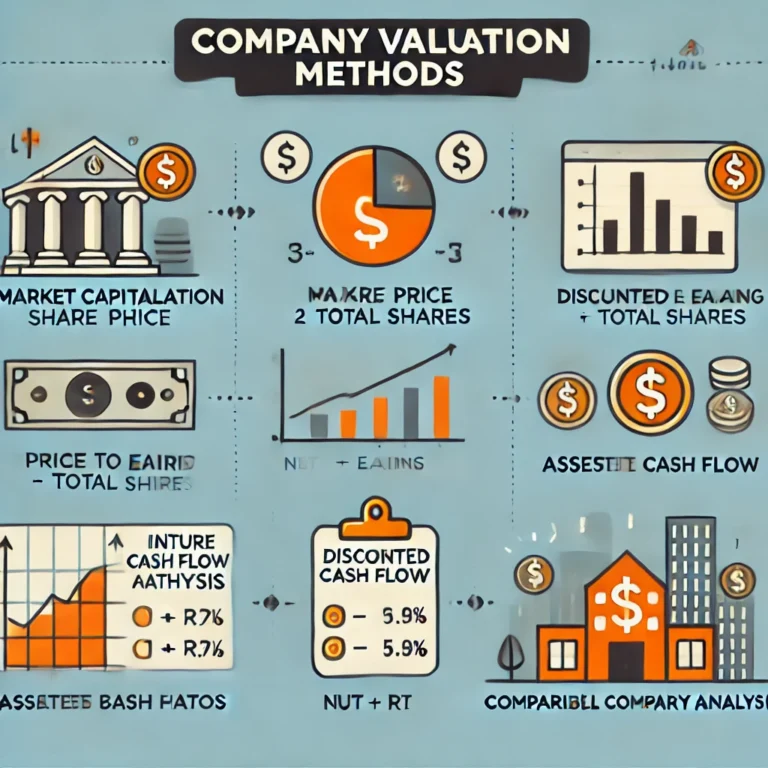

Top 5 Methods to Calculate Company Valuation

1. Market Capitalization (Best for Public Companies)

Market capitalization (market cap) is one of the simplest ways to value a publicly traded company.

Formula:

MarketCap=SharePrice×TotalOutstandingSharesMarket Cap = Share Price \times Total Outstanding SharesMarketCap=SharePrice×TotalOutstandingShares

Example: If a company has 1 million shares and each is worth $50, the market cap is:

1,000,000×50=$50,000,0001,000,000 \times 50 = \$50,000,0001,000,000×50=$50,000,000

Best for: Publicly traded companies.

2. Earnings Multiples (Price-to-Earnings Ratio – P/E Ratio) (Best for Profitable Companies)

This method uses the company’s earnings to determine its value, based on industry-standard multiples.

Formula:

CompanyValue=NetProfit×IndustryP/ERatioCompany Value = Net Profit \times Industry P/E RatioCompanyValue=NetProfit×IndustryP/ERatio

Example: If a company earns $2 million annually and the industry P/E ratio is 10:

2,000,000×10=$20,000,0002,000,000 \times 10 = \$20,000,0002,000,000×10=$20,000,000

Best for: Companies with stable profits.

3. Discounted Cash Flow (DCF) Analysis (Best for High-Growth Companies)

DCF valuation estimates a company’s worth based on its future cash flows, discounted to present value.

Formula:

DCF=CF1(1+r)1+CF2(1+r)2+…+CFn(1+r)nDCF = \frac{CF_1}{(1+r)^1} + \frac{CF_2}{(1+r)^2} + … + \frac{CF_n}{(1+r)^n}DCF=(1+r)1CF1+(1+r)2CF2+…+(1+r)nCFn

Where:

- CF = Expected future cash flows

- r = Discount rate (cost of capital)

- n = Number of years

Example: If expected cash flows are $1M per year for 5 years at a 10% discount rate, the present value is calculated accordingly.

Best for: Startups and high-growth companies with projected revenues.

4. Asset-Based Valuation (Best for Asset-Heavy Businesses)

This method calculates company valuation based on total assets minus liabilities.

Formula:

CompanyValue=TotalAssets−TotalLiabilitiesCompany Value = Total Assets – Total LiabilitiesCompanyValue=TotalAssets−TotalLiabilities

Example: If a company has $10M in assets and $3M in liabilities:

10,000,000−3,000,000=$7,000,00010,000,000 – 3,000,000 = \$7,000,00010,000,000−3,000,000=$7,000,000

Best for: Manufacturing and real estate companies with significant tangible assets.

5. Comparable Company Analysis (CCA) (Best for Industry Comparisons)

This method compares the business with similar companies in the market.

How it works:

- Identify similar companies.

- Compare valuation multiples (P/E ratio, EBITDA multiple, revenue multiple).

- Apply an industry average to your company’s financials.

Example: If similar businesses are valued at 5x their revenue and your company earns $4M annually:

4,000,000×5=$20,000,0004,000,000 \times 5 = \$20,000,0004,000,000×5=$20,000,000

Best for: Companies in competitive industries with available market data.

Which Valuation Method Should You Use?

| Method | Best For | Key Factor |

|---|---|---|

| Market Capitalization | Public Companies | Share Price & Shares Count |

| P/E Ratio | Profitable Businesses | Net Profit & Industry P/E |

| DCF Analysis | High-Growth Startups | Future Cash Flows |

| Asset-Based Valuation | Asset-Heavy Businesses | Assets & Liabilities |

| Comparable Analysis | Industry Comparisons | Market Data & Multiples |

Final Thoughts on Company Valuation

Calculating company valuation is essential for investors, business owners, and stakeholders. Whether you’re preparing for a sale, investment, or financial strategy, choosing the right valuation method depends on your company’s structure, profitability, and industry trends.

Want expert help? Consult a business valuation expert or use online valuation calculators for a quick estimate.

FAQs About Company Valuation

1. How do startups calculate valuation?

Startups often use the discounted cash flow (DCF) method or look at comparable companies to estimate value.

2. What is the easiest way to calculate business valuation?

The market capitalization method is the simplest for public companies, while asset-based valuation works best for small businesses.

3. Can a company have a negative valuation?

Yes, if liabilities exceed assets, the company’s net worth could be negative.

4. How often should a company valuation be done?

A valuation should be done annually or whenever there’s a major financial change, such as seeking investment or selling the business.

Download Our Free Company Valuation Calculator!

Get our FREE Business Valuation Calculator to estimate your company’s worth instantly! Download Here

Pingback: HOW TO CALCULATE CGPA ? (Cumulative Grade Point Average),