How to Calculate Gratuity in 2025 | Formula & Eligibility Explained

How to Calculate Gratuity: A Complete Guide

Gratuity is a financial benefit provided by employers to employees as a token of appreciation for their long-term service. If you’re wondering how to calculate gratuity, this guide will walk you through the eligibility, formulas, tax implications, and how you can use an online gratuity calculator for easy estimation.

Table of Contents

Toggle

What is Gratuity?

Gratuity is a lump sum payment made by an employer to an employee for their continuous service. In India, it is governed by the Payment of Gratuity Act, 1972 and applies to employees who have completed at least five years in an organization.

Who is Eligible for Gratuity?

To qualify for gratuity, an employee must meet the following criteria:

Must have completed at least five years of continuous service.

Should be working in an organization covered under the Payment of Gratuity Act.

The payment is applicable in cases of retirement, resignation, termination, or death (where nominees receive gratuity).

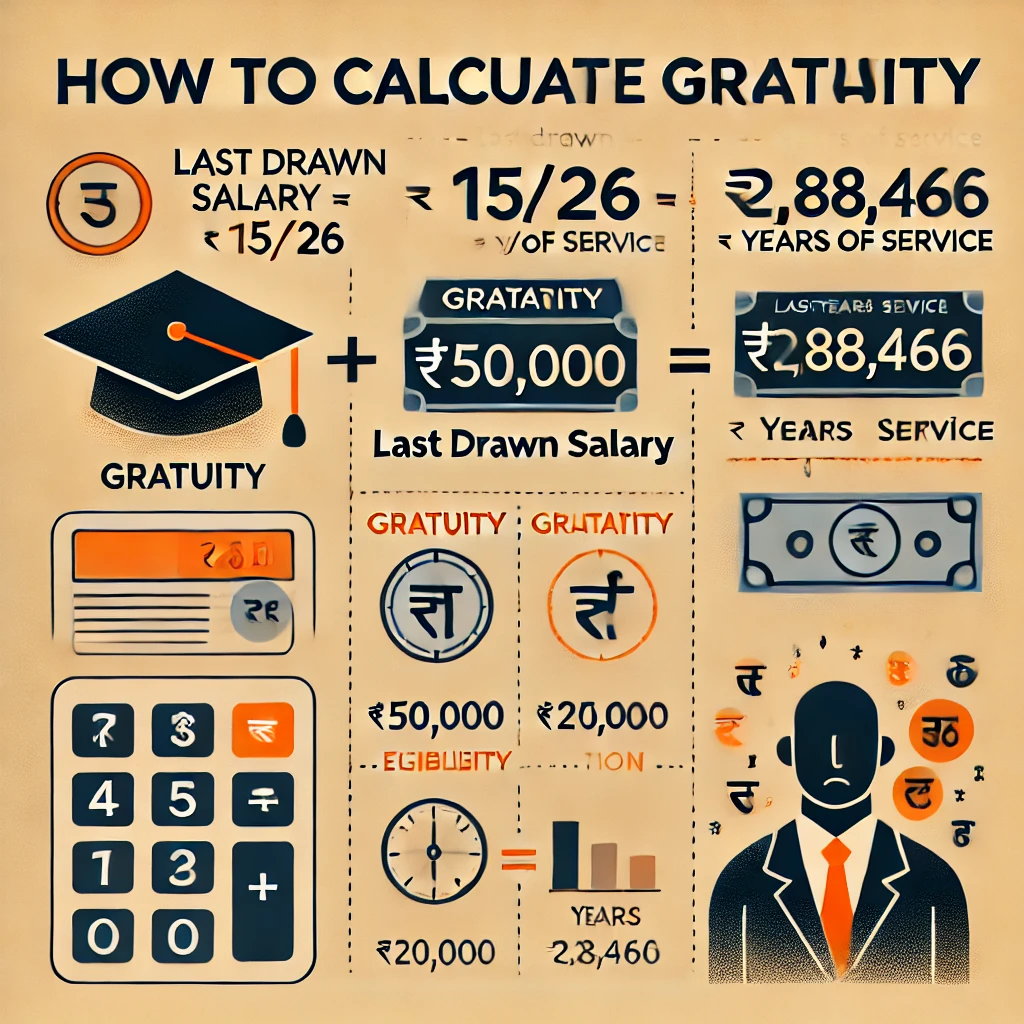

How to Calculate Gratuity?

The gratuity amount depends on the employee’s last drawn salary and total years of service. The standard formula for calculation is:

Gratuity Formula:

Where:

Last Drawn Salary = Basic Salary + Dearness Allowance

15/26 = Represents 15 days of salary for each completed year

Years of Service = Rounded to the nearest full year

Example Calculation:

If an employee has worked for 10 years and their last drawn salary is ₹50,000:

For employees not covered under the Payment of Gratuity Act, the formula is slightly different:

Tax Implications of Gratuity

The tax treatment of gratuity varies depending on the type of employment:

Government Employees: Fully tax-exempt.

Private-Sector Employees: Exempt up to ₹20 lakh under Section 10(10) of the Income Tax Act.

Any amount exceeding ₹20 lakh is taxable as per the applicable income tax slab.

Online Gratuity Calculator

Instead of manually calculating gratuity, you can use an online gratuity calculator to get an accurate estimate. Just enter your last drawn salary, total years of service, and whether your employer falls under the Payment of Gratuity Act.

Conclusion

Gratuity is an essential financial benefit that rewards employees for their service. Understanding how it is calculated helps in planning your finances better. Whether covered under the Gratuity Act or not, knowing the formula ensures you have a clear idea of the amount you’re entitled to receive.

Pingback: How to Calculate Body Mass Index (BMI) with Example